Get ready for a golden future

- Regular payments starting from 4 EUR

- The option to make unscheduled payments

- Save up to 35% when buying 1 gram of gold

- Savings in the form of physical investment bars and coins

The freest way to save in gold

Reap the rewards of your gold investment in iiplanRentier® and iiplanGold® savings

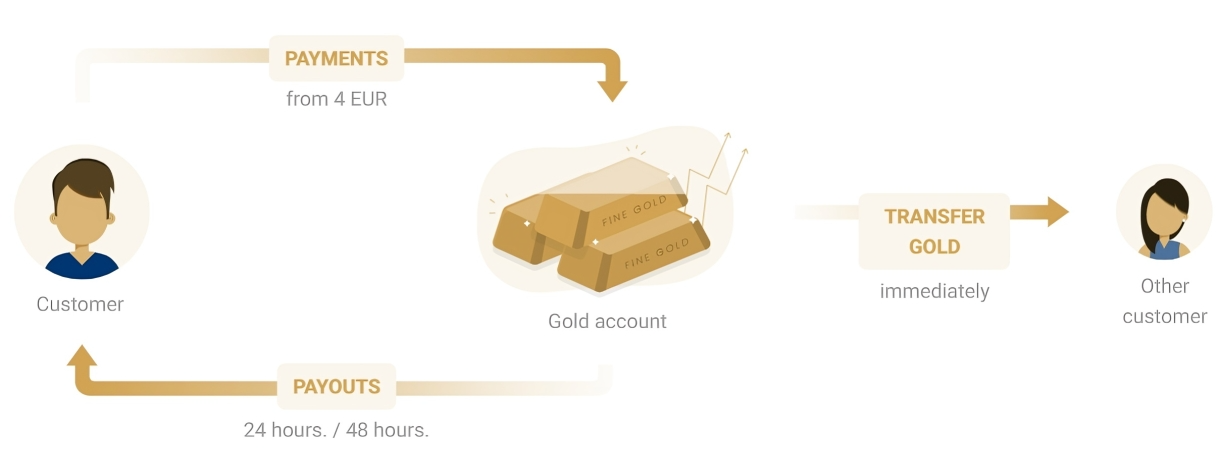

Payments

- from 4 EUR

- regular and unscheduled payments

- currency as per your contract

Payout in metals

- within 48 hours

- gold, silver

- bars, coins, selection of sizes

Cash payout

- within 24 hours

- regular annuity or lump-sum payout

- choice of currency

Transfer gold

- immediately

- transfer of grams of gold to another contract

- iiplanRentier®, iiplanGold®

Want to know how to start saving?

Having a gold account or gold annuity is really easy

1. Step

Contract arrangement

2. Step

Contract arrangement

1. Step

Payouts and shipping

True wealth

In the iiplanRentier® and iiplanGold®, you purchase investment gold incrementally in the form of investment bars from the Swiss PAMP refinery under very attractive terms.

- Physical gold investment bars

- Highly attractive price of gold

- VERISCAN™ security system

Commitment-free security

It is entirely your decision how much of your savings you invest in gold. Grams purchased under iiplanRentier® and iiplanGold® will become your gold account, which you are free to dispose without restriction. You enter your instructions online.

- Personal savings amount

- Make unscheduled deposits or suspend your savings

- Adjust your savings arrangements without incurring fees and penalties

Accessible savings

Need cash? Want to collect a gold or silver bar or coin? Under iiplanRentier® and iiplanGold®, you can opt for an interim payment in cash, gold or silver. Also, you are free to transfer the grams held in your account between contracts without restriction.

- Transferring grams between contracts online

- Cash payouts within 24 hours

- Gold and silver payouts within 48 hours

- Confirmation of payouts and transfers via the IBIS InGold Key app

Regular gold annuity

Payouts from your account may also be made with regular frequency. In this way, you can set up a regular annuity to supplement your monthly income, for example. iiplanRentier® and iiplanGold® are truly advanced, all-purpose schemes to build up medium- and long-term reserves.

- Regular payouts from your gold account

- Worry-free long-term annuity payouts

- Choice of payout currency

- Online overview of payouts

Payout in metals

Cash payout

Transfer grams

You are shaping your future right now!

Make the most of your gold account and gold annuity

Secure your retirement

Take care of your children’s future

Protect your savings against inflation

Build up a fund for your lifelong dreams

Gold account or gold annuity?

Choose the savings scheme that suits you best

You can use iiplanGold® in a similar way to a savings account – the only difference being that your savings are held in physical gold.

A gold account comes into its own when you want to put your money in a safe place for a while in an asset not exposed to inflation. iiplanGold® offers the lowest per-gram price of gold and is ideal for your medium-term goals.

- Lowest per-gram price of gold

- Inflation-proofing for your savings

- Designed in particular for medium-term goals

Are you planning to build up a nest egg for your retirement, or would you like a savings product to provide financial support to your children, either when they become independent or during their studies?

Choose iiplanRentier®, which is ideal for long-term savings with an investment term of at least 10 years. Build up a gold annuity that can be taken out as a lump sum or on a rolling basis.

- Preparing an annuity for retirement

- Saving for children, their studies and independence

- Designed for long-term goals

Enjoy freedom in how you save

Other benefits of savings…

More competitive per-gram price of gold and silver

The higher the weight of investment bars and coins, the lower the per-gram price of the precious metal. With the savings schemes, you are in no way handicapped by your available funds, as you can buy gold in larger bars incrementally at a price up to 35% cheaper.

Savings tailored to your needs

Save in the way that works best for you! You can set the amount of your regular contributions and the frequency of your payments to your liking and in line with your means. You alone decide what bars or coins to buy. We will be happy to draw up an offer specific to your situation.

Flexibility in savings and payouts

Life throws up all sorts of changes, so we allow you to adjust how you save. You can adjust the amount of your payments at any time, and you can speed up your precious metal purchases with unscheduled payments. You can have your savings paid out and the bars and coins that have been shipped to you bought back during the savings period.

Bar and coin delivery, or deposit free of charge

We ship investment bars and coins to you as per your instructions. With our savings schemes, you can even keep your bars and coins in our vaults free of charge for the duration of your contract.

Online arrangements

We will be happy to help arrange a draft contract for you, but you can also prepare it yourself online if you wish. We will email you pre-contractual information and a draft contract. You confirm the contract by making your initial payment.

Online savings overview

You can track the progress of your savings and purchases in your customer account, which we will set up immediately after the draft contract is dispatched or after you sign up. Simply log in to see your contracts, portfolio, processed payments and precious metals purchases.

Good advice is worth its weight in gold

Tell us what’s important to you when it comes to building up your savings, and we’ll put together an offer just for you

Buyback guarantee

Certainty and security are a priority for us. We guarantee our customers that they are the first owners of the investment bars and coins they purchase from us, and that we will also buy them back from them. So if you decide to sell your gold, please return to us.

When should you include gold in your reserves?

It’s not a question of when, the most important thing is simply to get started and reap the benefits that investing in physical investment gold offers. Become independent and enjoy your freedom. Investment bars and coins are tangible assets, not promises on paper.

Why use gold as a savings vehicle?

What you pay is the price. What you get is the value

Appreciation

Investment gold is a long-term strategy for growing your wealth. It records long-term price gains averaging approximately 7% p.a.

Diversification

Gold has a unique role to play in portfolio diversification. The price of gold and the price of stocks, bonds and real estate often follow different paths.

Liquidity

Gold is a known commodity all over the world, which is why you’ll hear it referred to as a global currency. It’s rare, can’t be manufactured and its demand is soaring.

Stability and security

Gold offers security at times of economic turmoil. It is a safeguard against inflation and market volatility. Because it retains its value over many years, it can be passed down from generation to generation.

Discover the security of gold with IBIS InGold

More than 80,000 customers

A direct connection to the PAMP refinery and The Royal Mint

Products and services sold throughout Europe

Savings schemes and one-off purchases

Customer support and service

Security and value

Unlike currencies, gold has never gone bankrupt and has always retained its value. The savings you place in gold will buffer you against the effects of inflation.

A good investment

Besides being a reliable store of value, gold can be a profitable investment. It has a long history of delivering 7 % annual appreciation.

Liquidity and independence

Gold is a known commodity all over the world and can be exchanged for any currency. Its price is independent of government systems or the capital worth of companies. And that’s why it gives freedom to you too.

Assurance and stability

Physical investment gold is a tangible asset that you can hold. Plus, it will serve as an anchor for your other family assets and investments.